[fusion_builder_container type=”flex” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” border_style=”solid”][fusion_builder_row][fusion_builder_column type=”1_1″ type=”1_1″ background_position=”left top” background_color=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=”” border_sizes_top=”” border_sizes_bottom=”” border_sizes_left=”” border_sizes_right=””][fusion_text]

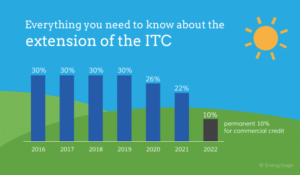

The federal solar tax credit, also known as ITC (investment tax credit), enables one to deduct around 26 percent of the total expense of solar energy system installation from your federal taxes. For instance, if you spend $10,000 on your system, then you would owe $2,600 less in taxes. The Investment Tax Credit is available to both commercial and residential systems, and there is no cap on its value. Since the ITC was implemented, there has been an annual solar growth of over 50%!

History of the ITC 9 (investment tax credit)

The ITC was initially established by the energy policy act of the year 2005 though it was set to expire in the year 2007. However, it became so successful in helping the US transition to a renewable energy economy, and Congress extended its expiration date multiple times. Currently, the solar investment tax credit is available to every homeowner in the United States of America.

How Does the Solar Tax Credit Work?

It is very easy as anyone who owns a solar energy system is eligible for the solar investment tax credit. This is even when you do not possess enough tax liability. One can easily overwrite the subsequent credit into the coming years if the tax credit is fully in effect. It is worth noting that in case you go for a PPA or a lease with a solar installation company, you will not be the rightful owner of that system, and therefore, you won’t be eligible to receive the tax credit, and that isn’t good. Something to keep in mind if considering a leasing option. Also, something to keep in mind is that the amount will, unfortunately, start to decrease after 2019. So the sooner you act, the more tax savings you’ll incur.

How can one claim the ITC (investment tax credit)?

Acquiring the investment tax credit is not that complicated. You will be able to claim the ITC once you fully file your yearly federal tax return by using IRS form 5965. Remember to inform the accountant that you’ve gone solar for a year, and if you normally file your taxes, ensure that you use EnergySage’s step-by-step guide on how to easily claim your investment tax credit (ITC).

Solar is still being recognized as a clean energy source and will continue to offer homes and businesses incentives, but they have already started to dwindle off. By 2022, there will only be a 10% tax credit available. If you are still considering getting solar panels, you may want to take advantage of these credits before they expire. It makes solar cheaper for homeowners. Call us for an assessment of your home today and join us in the solar revolution!

*This article is for informational purposes only, please consult a tax professional for advice.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]